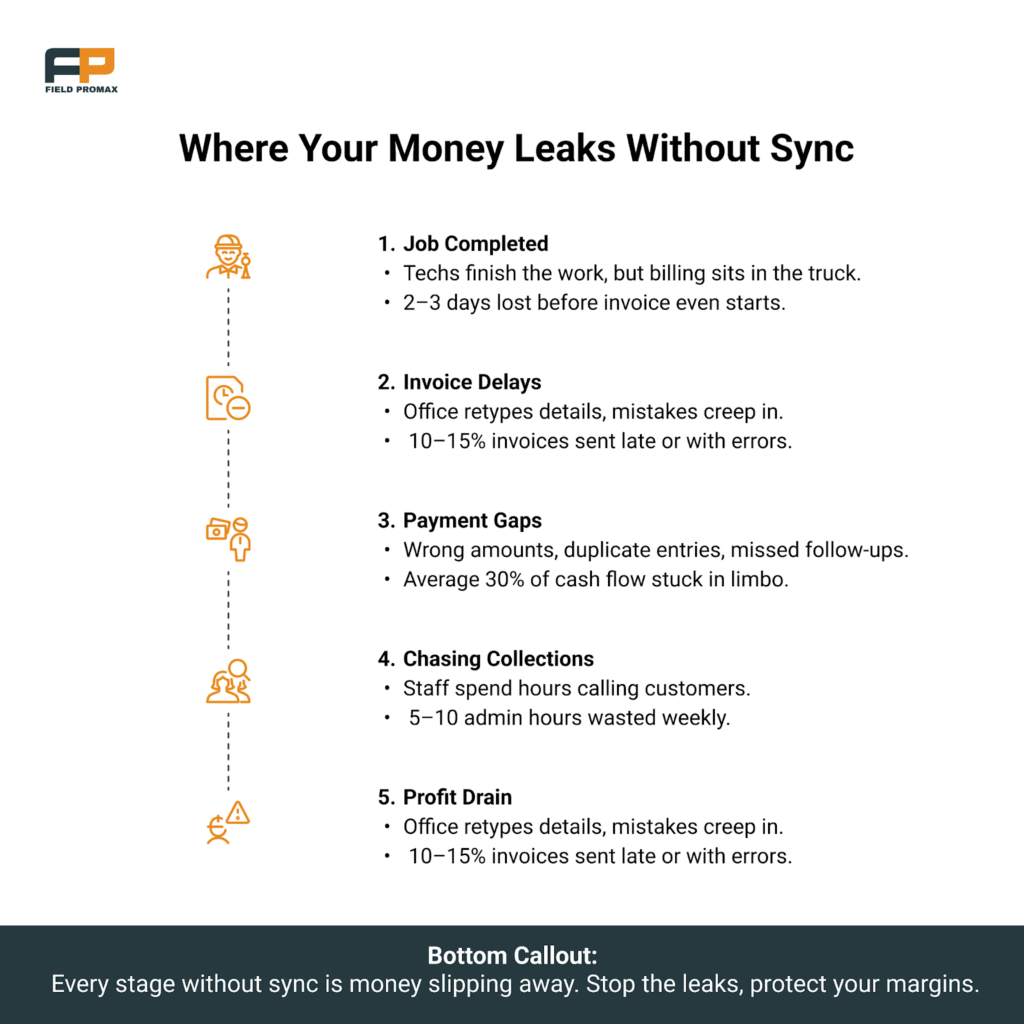

The work of running a pest control business is stressful. In one hour, you’re planning routes and the next, you’re addressing the phone calls of customers, and by the close of the week, you’re looking at invoices that aren’t in line with your finances.

It’s stressful and usually boils down to one issue: accounting isn’t syncing with your company.

The latest software for pest management addresses this problem by connecting directly to accounting software. Instead of typing invoices into QuickBooks or tracking down payment manually, the office and field remain in the exact same place. What tools can provide an accurate sync? Let’s dig in.

Why Accounting Sync Matters for Pest Control Businesses

For service businesses, time is money. If your office staff is spending long hours reconciling payment this is time that could be spent on scheduling work or gaining new customers. Accurate accounting sync services:

- No double entry – customer, invoice and payment information flow seamlessly.

- Quicker cash flow – Field payments will hit your bank accounts right away.

- Transparent visibility – Owners can see the receivables and expenditures in real-time.

- More accurate – The synchronization process reduces errors caused by manually entering data.

A pest control company owner in Georgia explained it in simple terms: “Before sync, I did not know who was responsible for what at the close of the month. I now have the ability to check it any time via my smartphone .”

What Makes Sync Truly Reliable?

Different software does not offer the same standard of service. A solid integration should contain:

- Data movement in two directions which means that invoices, customers and payment information are updated across both systems.

- Automated invoice creation when jobs are shut on the job.

- Cost-of-job tracking for labor, chemicals and travel expenses.

- Mobile invoice allows techs to make and sync payments on the spot.

- Support and error handling which can detect issues fast.

- The ability to scale for small teams as well as multi-location businesses.

The Most Reliable Tools for Accounting Sync

Field Promax

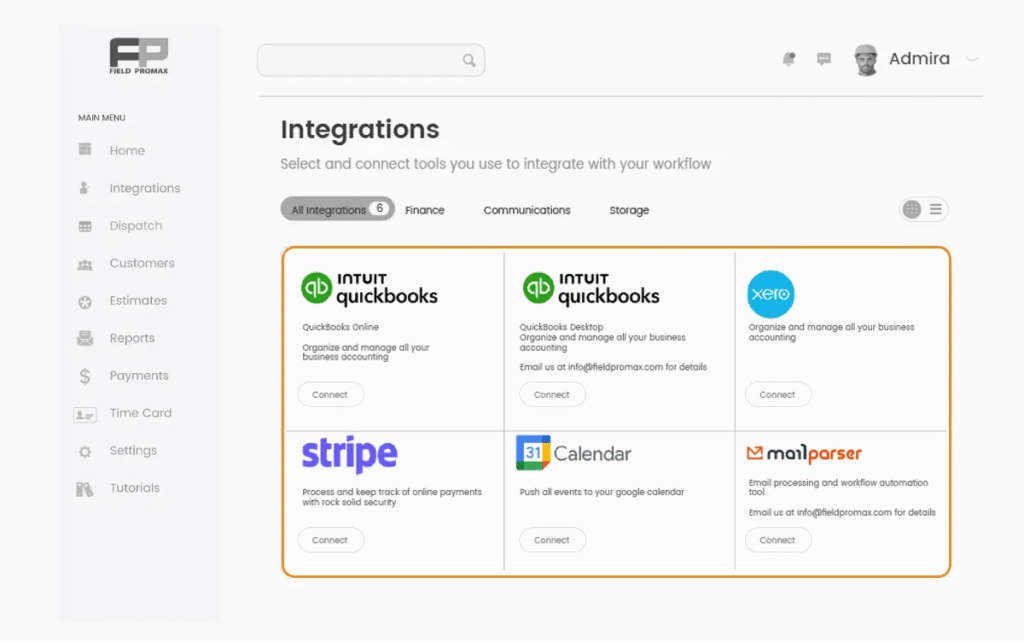

Field Promax is designed for companies that provide field services and puts accounting at the heart of their business.

- Advantages: QuickBooks integration, work order digitalization, precise job costing and smooth invoicing via mobile. Techs can close jobs within the application, and invoices show up in QuickBooks immediately.

- Watch out for: Setup requires clean accounting data. Some owners claim that customizing takes some time, but the support team is very responsive.

User feedback:

- “Field Promax reduced my time for invoicing by half. I no longer use spreadsheets. .”

- “I used to be a reconciler on Fridays. Then QuickBooks updates itself automatically whenever jobs are completed .”

FieldRoutes

- Strengths: Strong QuickBooks sync and regular billing, dashboards for invoicing that is overdue.

- Beware of: Learning curve and price increases as teams grow.

PestPac (by WorkWave)

- The advantages: Detailed reporting, ongoing contract management API choices for QuickBooks.

- Beware of: Interface feels complex and the quality of support varies.

Jobber

- The advantages: QuickBooks as well as Xero Integrations, bulk invoices as well as reminders. Ideal for teams with smaller numbers.

- Beware of: Less detailed job-cost tracking for chemicals and large teams.

GorillaDesk

- Advantages Simple, affordable QuickBooks Integration, and field invoice.

- Beware of: Reporting tools are restricted compared to enterprise systems.

Housecall Pro

- Strengths: Recurring bill, robust mobile invoicing and QuickBooks sync.

- Beware of: Advanced features are included in the higher-level plans that are paywalled.

Smart Service

- The advantages: Directly as an add-on to QuickBooks, with seamless job-to-invoice conversion.

- Beware of: Dependent on QuickBooks updates, and sometimes payroll requires an add-on.

Real-World Stories

- Small-scale operation in Texas using Jobber and QuickBooks, overdue invoices decreased by 30% when automated reminders were in place.

- A regional company located in Florida after moving to Field Promax, the owner told me, “I check my dashboard Monday morning and each payment that was made last week is in QuickBooks. It used to take my administrator two days to get everything in. .”

- Pest control for a commercial company in California The team used PestPac it synced with regular contracts and cut auditing errors by 25%..

- Multi-branch firm located in New York: After switching to Field Promax, the CFO said, “We run five branches and reconcile invoices used by three different individuals. The sync now handles everything. Our accounting team is spending studying numbers, instead of writing them .”

Checklist for Choosing the Right Tool

Do ask yourself:

- What number of technicians can I employ?

Small teams may be able to find Field Promax or Jobber sufficient. Larger organizations should think about PestPac, or FieldRoutes. - What accounting platform should I choose to use?

Most tools work best with QuickBooks. Verify compatibility if you’re using Xero. - Do I require a real-time field invoice?

If yes, look for tools that support Mobile payment sync. - What is the complexity of my accounting, costing me?

If you are concerned about chemical tracking, pick an application that can sync job-level costs. - What’s my plan for growth?

Pick a tool that will not require replacement within two years. Tools can Field Promax can help you grow.

Best Practices for Smooth Setup

- Cleaning your book initially. Remove duplicates and make job codes consistent.

- Conduct a test pilot. Sync a small batch of jobs prior to a full launch.

- Train more than one individual. Avoid depending on only one employee.

- Look up logs of errors. A reliable system should be able to identify sync issues clearly.

- Utilize dashboards for weekly analysis. Don’t wait until the month’s end to find problems.

Frequently Asked Questions

1. What is the importance of accounting sync to control pests?

Because each late or missed payment can affect the flow of cash. Sync makes sure that your books are up to date.

2. Which accounting system is most commonly used?

QuickBooks Online leads the way and is then Xero. Field Promax, Jobber, and FieldRoutes all work with QuickBooks connections.

3. Can invoices created by technicians can be instantly synced.

Through Field Promax and similar tools Jobs that are closed within the app will appear in QuickBooks in a matter of minutes.

4. How fast do companies get ROI?

Many companies say they have reduced administrative time and the reduction of late invoices in 1-3 months.

5. What’s the most frequent error ?

Starting the sync process without clear information. Incorrect codes and duplicates create serious problems.

6. Do small businesses require expensive tools?

Not necessarily. Solo workers can be successful with GorillaDesk. However, companies with larger teams or compliance requirements should look into Field Promax, PestPac, or FieldRoutes.

7. What is the role of compliance?

Tools like Field Promax and PestPac include the ability to track chemical usage and compliance logs. This makes these tools more reliable in audits.

8. How much are they worth?

The entry-level tools are less expensive however they may be lacking in depth. Higher-end tools cost more, however they usually save money via lower errors and faster payment.

9. Do I have the option of switching later in case I have outgrown my program?

Yes, but moving is messy. If you are expecting to grow, you should start by choosing a scalable solution.

10. What do real users have to say on Field Promax?

Many highlight its credibility. One user shared: “QuickBooks along with my team in the field have finally spoken the same language.”

11. Is accounting sync secure?

Yes. Modern pest control systems utilize encrypted connections to connect to QuickBooks and Xero. Tools such as Field Promax never store sensitive information about payments directly, they transfer it securely to the accounting software.

12. How much will it cost to change tools if I select the wrong tool?

Changing isn’t always free. Transferring data, retraining personnel, and cleaning up records could take several weeks. It’s the reason it’s so important to ensure that tools are thoroughly tested by running a test before making a decision to commit.

Conclusion

Synchronizing accounting is not only a function, It’s a lifeline. Pest control companies need an efficient sync which will mean fewer errors, more efficient payments as well as peace of mind.

Field Promax leads the list in terms of reliability along with FieldRoutes, PestPac, Jobber, GorillaDesk, Housecall Pro as well as Smart Service also offering solid alternatives. The most appropriate choice is contingent on the size of your team, the workflows you use, as well as your expansion plans.

Select the appropriate software, set it up correctly, and you’ll get an incredible benefit: time to focus on the customer instead of trying to chase invoices.

Author Bio –

I’m Bhargavi Halthore, and I’ve spent the last six years diving deep into the world of digital marketing and tech. Working closely with startups and tech wizards alike has kept me entertained. What excites me most is watching how software can completely transform a business! Breaking down complex technological concepts so everyone understands them is my specialty. When not exploring these latest business software trends I can usually be found sharing what I have learned at events around America or Canada.

Jared H. Furness loves sports! He writes about football, basketball, and baseball. He looks at player stats and tells fun, easy stories. His articles are very simple to read. Everyone can understand them! You can find his writing on big sports websites. He talks about how players play, exciting game moments, and smart plans. For example, he writes about games like Boston College Eagles vs. UVA and Arizona Diamondbacks vs. Miami Marlins. Jared writes his own stories, and they follow Google’s rules. They’re easy to find on Google and never copied. Fans and experts love his stories about stars like Bobby Witt Jr. and fun EuroLeague basketball moments. Jared makes sports writing super fun and clear!